The magic of compound interest

The magic of compound interest

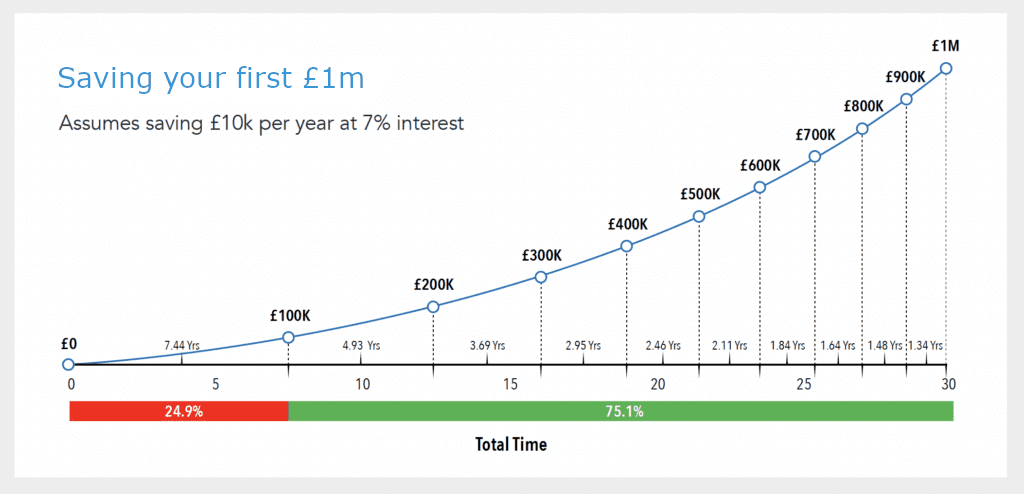

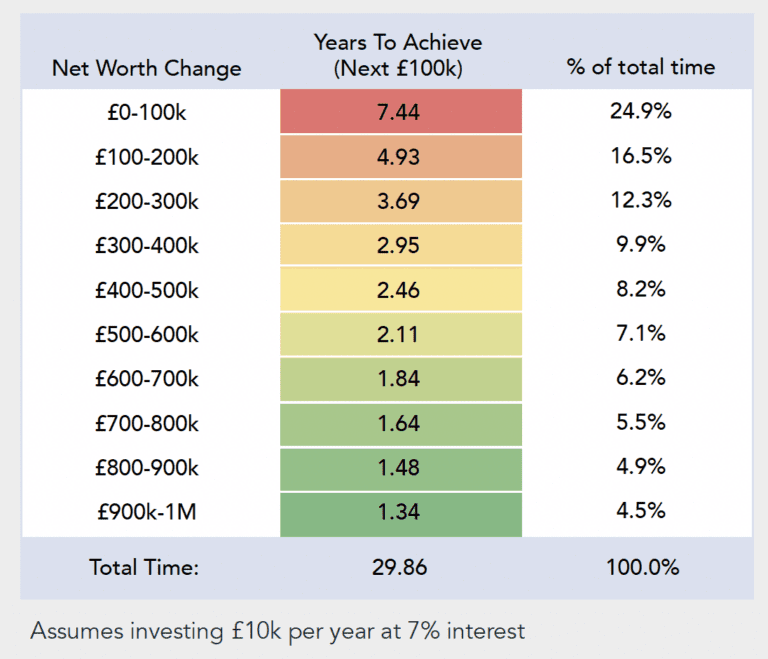

The key to compound growth is getting started and staying invested for the long-term. The longer you remain invested, the greater the potential returns on what you've already invested. Here's another example to show you the power of compound interest: Let's say you invest £10,000 per year at 7% interest. The longer you remain invested, the quicker your money grows.

For example, your first £100k would take 7.44 years to save, but the final £100k (going from £900k to £1million) would only take 1.34 years. This is due to the interest you earn on interest, which helps your portfolio grow at an increasing rate year to year.

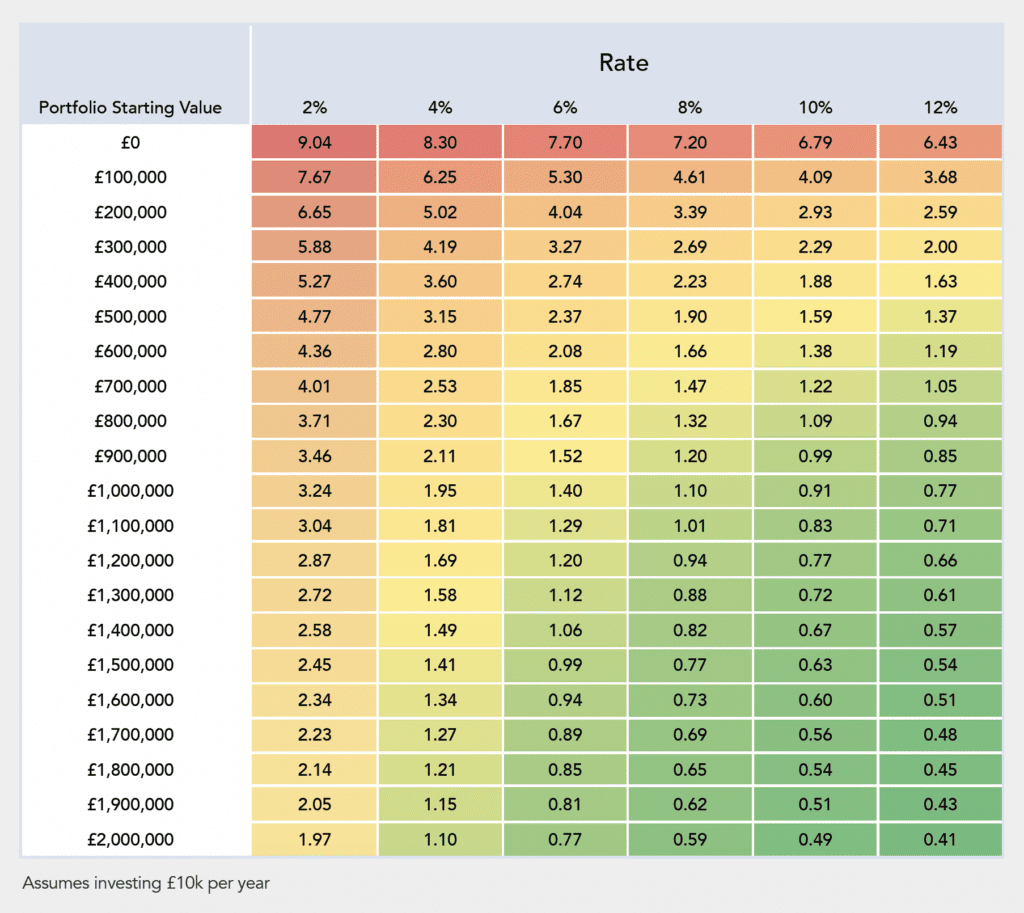

It's important to consider your return assumptions when thinking about compound interest. As your returns increase, the time it takes to save the next £100k will decrease. For example, starting from £0 at 2% per year, it would take 9.04 years to save the first £100k. But if you assume a return of 12% per year, the time taken to save the first £100k falls to 6.43 years.

Another thing to consider is your portfolio size. If you assume a return of 2% per year, starting from £0, the first £100k will take 9.04 years to save. However, if you started with £1 million, the first £100k would only take 3.24 years to save.

I hope this helps you understand the power of compound interest and how it can help you grow your investments over time.

Sam, Startup. ‘Compound the Pound, Blog Post’. EBI Evidence Based Investing, 24 March 2023. https://ebi.co.uk/blog/compound-the-pound/.

The value of units can fall as well as rise, and you may not get back all of your original investment.